62. Reduction of tax deductible in relation to qualifying vehicles.

(a) This subsection applies where an accountable person deducts tax in relation to the purchase, intra-Community acquisition or importation of a qualifying vehicle (within the meaning of section 59(1)) in accordance with section 59(2)(d), and disposes of that vehicle within 2 years of that purchase, acquisition or importation.

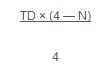

(b) The accountable person shall be obliged to reduce the amount of the tax deductible by that person for the taxable period in which the qualifying vehicle is disposed of by an amount calculated in accordance with the formula -

where -

TD is the amount of tax deducted by that person on the purchase, acquisition or importation of that vehicle, and

N is a number that is equal to the number of days from the date of purchase, acquisition or importation of that vehicle by that person to the date of disposal by that person, divided by 182 and rounded down to the nearest whole number,

but if that N is greater than 4 then N shall be 4.