Article 4 The liquidity coverage ratio

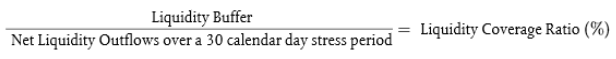

1. The detailed liquidity coverage requirement in accordance with Article 412(1) of Regulation (EU) No 575/2013 shall be equal to the ratio of a credit institution's liquidity buffer to its net liquidity outflows over a 30 calendar day stress period and shall be expressed as a percentage. Credit institutions shall calculate their liquidity coverage ratio in accordance with the following formula:

2. Credit institutions shall maintain a liquidity coverage ratio of at least 100 %.

3. By derogation from paragraph 2, credit institutions may monetise their liquid assets to cover their net liquidity outflows during stress periods, even if such a use of liquid assets may result in their liquidity coverage ratio falling below 100 % during such periods.