2. Amendment of section 45 (distributions) of Finance Act, 1980.

Section 45 of the Finance Act, 1980, is hereby amended by the insertion after subsection (3) of the following proviso to that subsection:

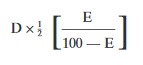

"Provided that where, as respects an accounting period, corporation tax payable by a company is, by virtue of subsection (9) (inserted by section 1 of the Finance (No. 2) Act, 1992) of section 41, reduced by the revised relief (within the meaning of the said subsection (9)), the tax credit in respect of a distribution treated for the purposes of this section as made for the accounting period shall be an amount determined by the formula -

D is the amount or value of the distribution, and

E is an amount determined by the formula -

T

_× 100

I

where -

T is the corporation tax payable by the company for the accounting period, so far as it is referable to income from the sale of those goods (within the meaning of section 41), after deducting from that tax such amount as falls to be deducted under the said section 41, and

I is the said income from the sale of those goods.".