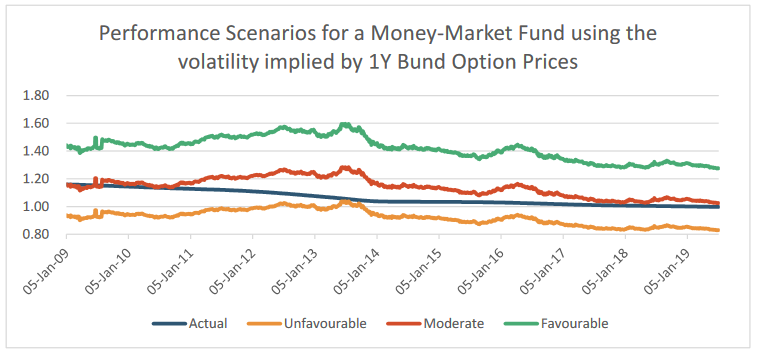

The following plot is similar to the plots shown above using the proposed methodology. The fund is a French money-market fund. The recommended holding period is again 5 years.

The plot illustrates the difficulty of constructing a reasonable range of outcomes for money market funds using historical volatility. Money market funds have a very low volatility that is not representative of the volatility of the underlying interest rate which determines the return. In a falling interest rate environment, as is the case for most of the period 2005-2014, the observed return will always be below the unfavourable scenario.

The following plot shows performance scenarios constructed assuming an annualized volatility consistent with the average implied volatility of options on the German Bund Futures. From this plot it is clear that the observed performance never exceeds either the unfavourable scenario (rates moving down) or the favourable scenario (if rates were to move up).