Annex III Duration netting rules

1. An interest rate derivative shall be converted into its equivalent underlying asset position in accordance with the following methodology:

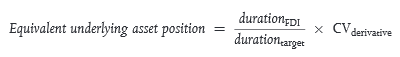

The equivalent underlying asset position of each interest rate derivative instrument shall be calculated as its duration divided by the target duration of the AIF and multiplied by the equivalent underlying asset position:

where:

- durationFDI is the duration (sensitivity of the market value of the financial derivative instrument to interest rate movements) of the interest rate derivative instrument,

- durationtarget is in line with the investment strategy, the directional positions and the expected level of risk at any time and will be regularised otherwise. It is also in line with the portfolio duration under normal market conditions,

- CVderivative is the converted value of the derivative position as defined by the Annex II.

2. The equivalent underlying asset positions calculated in accordance with to paragraph 1 shall be netted as follows:

(a) Each interest rate derivative instrument shall be allocated to the appropriate maturity range of the following maturity-based ladder:

Maturities ranges

1. 0-2 years