2 Supervisory cycle

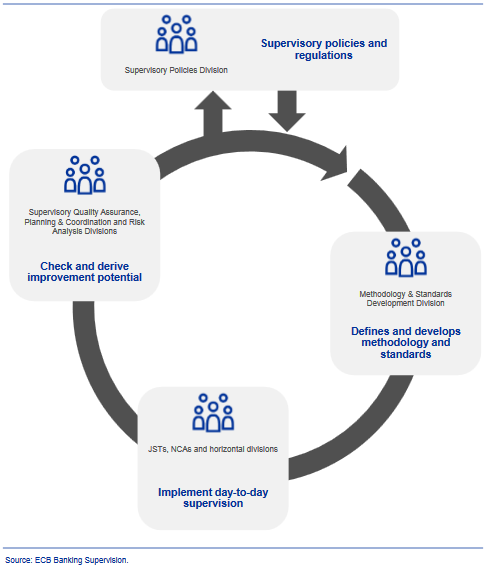

The banking supervision process can be viewed as a cycle, as shown in Figure 9. The separate elements of the supervisory cycle are explained in this chapter. Regulation and supervisory policies (see Section 2.1) provide the foundation for supervisory activities and for the development of supervisory methodologies and standards (see Section 2.2).

Figure 9 The supervisory cycle

The methodologies and standards underpin the day-to-day supervision that is carried out to the same high standards across all credit institutions (see Section 2.3). Through various channels, including the SSM’s participation in international and European fora, the lessons learnt in the course of supervision and the performance of quality assurance checks (see Section 2.4) feed back into the further development of methodologies, standards, policies and regulations.

The experience gained from the practical implementation of the methodologies and standards feeds into the planning of supervisory activities for the forthcoming cycle. This planning also incorporates the analysis of key risks and vulnerabilities and the setting of strategic supervisory priorities.

2.1 Contributing to regulations and supervisory policies

Basel Accords