16. Retirement benefits.

(1) The Principal Act is amended -

(a) in section 784A(1BA) by deleting paragraph (a) and substituting the following for paragraph (c):

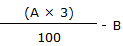

"(c) The specified amount for a year of assessment shall be an amount equivalent to the amount determined by the formula -

where the amount so determined is greater than zero and where -

A is the value of the assets in an approved retirement fund on 31 December in the year of assessment or, where there is more than one approved retirement fund the assets of which are owned by the same individual and managed by the same qualifying fund manager, the aggregate of the value of the assets in each approved retirement fund on that date (in this subsection referred to as the 'relevant value' whether there is one or more than one such approved retirement fund), and

B is the amount or value of the distribution or the aggregate of the amounts or values of the distribution or distributions (in this subsection referred to as the 'relevant distribution'), if any, made during the year of assessment by the qualifying fund manager in respect of assets held in -

(i) the approved retirement fund or, as the case may be, approved retirement funds referred to in the meaning of 'A', and