12. Deduction for income earned in certain foreign states.

(1) The Principal Act is amended -

(a) in Part 34 by inserting the following after section 823:

(1) In this section -

'qualifying day', in relation to an office or employment of an individual, means a day on or after 1 January 2012 which is one of at least 4 consecutive days throughout the whole of which the individual is present in a relevant state for the purposes of the performance of the duties of the office or employment and which (taken as a whole) are substantially devoted to the performance of such duties, but no day shall be counted more than once as a qualifying day;

'relevant office or employment' means an office or employment part of the duties of which are performed in a relevant state on a qualifying day;

'relevant period', in relation to a year of assessment, means a continuous period of 12 months part only of which is comprised in the year of assessment;

'relevant state' means the Federative Republic of Brazil, the Russian Federation, the Republic of India, the Peoples Republic of China or the Republic of South Africa;

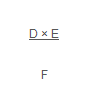

'the specified amount', in relation to a year of assessment and an individual, means an amount determined by the formula -

where -

D is the number of qualifying days in the year of assessment in relation to the individual,