I. Quantitative disclosure - description of a bank's securitisation exposures

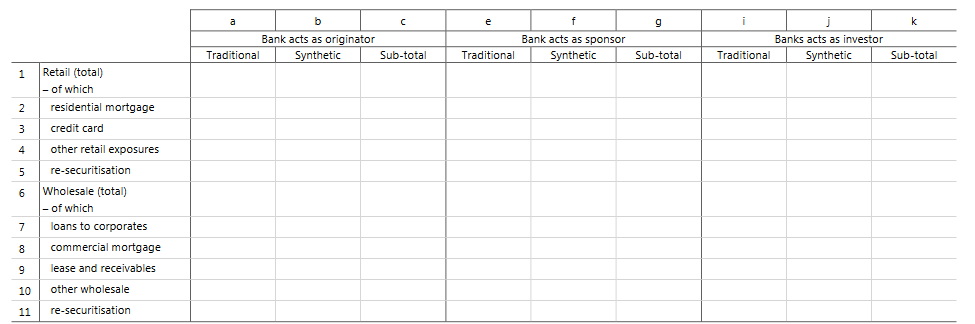

Template SEC1: Securitisation exposures in the banking book

|

Purpose: Present a bank’s securitisation exposures in its banking book. |

|

Scope of application: The template is mandatory for all banks with securitisation exposures in the banking book. |

|

Content: Carrying values. In this template, securitisation exposures include securitisation exposures even where criteria for recognition of risk transference are not met. |

|

Frequency: Semi-annually. |

|

Format: Flexible. Banks may in particular modify the breakdown and order proposed in rows if another breakdown (eg whether or not criteria for recognition of risk transference are met) would be more appropriate to reflect their activities. Originating and sponsoring activities may be presented together. |

|

Accompanying narrative: Banks are expected to supplement the template with a narrative commentary to explain any significant changes over the reporting period and the key drivers of such changes. |

|

Definitions (i) When the "bank acts as originator" the securitisation exposures are the retained positions, even where not eligible for the securitisation framework due to the absence of significant and effective risk transfer (which may be presented separately). |