II. Quantitative disclosure - calculation of capital requirements

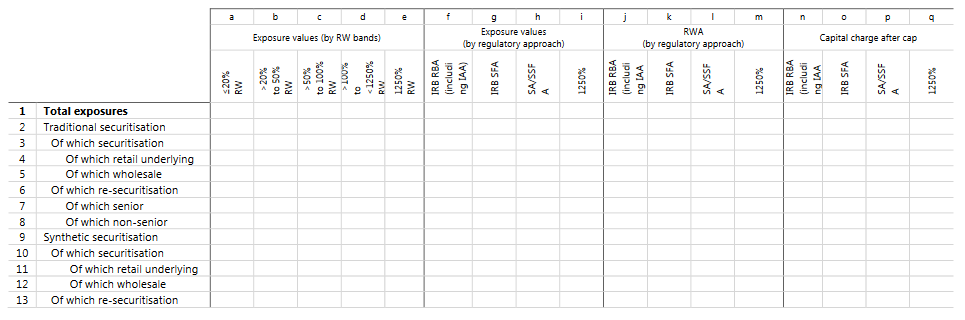

Template SEC3: Securitisation exposures in the banking book and associated regulatory capital requirements - bank acting as originator or as sponsor

|

Purpose: Present securitisation exposures in the banking book when the bank acts as originator or sponsor and the associated capital requirements. |

|

Scope of application: The template is mandatory for all banks with securitisation exposures as sponsor or originator. |

|

Content: Exposure values, risk-weighted assets and capital requirements. This template contains securitisation exposures only where the risk transference recognition criteria are met. |

|

Frequency: Semiannual. |

|

Format: Fixed. The format is fixed if consistent with locally applicable regulations. The breakdown of columns (f) to (h), (j) to (l) and (n) to (p) may be adapted at jurisdiction level where necessary. |

|

Accompanying narrative: Banks are expected to supplement the template with a narrative commentary to explain any significant changes over the reporting period and the key drivers of such changes. |

|

Definitions Columns (a) to (e) are defined in relation to regulatory risk weights. |