23. Limitation on amount of certain reliefs used by certain high income individuals.

(1) Chapter 2A of Part 15 of the Principal Act is amended -

(a) in section 485C(1) by inserting the following definitions after the definition of "excess relief":

"'income threshold amount', in relation to a tax year and an individual, means -

(a) €125,000, or

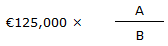

(b) in a case where the individual's income for the tax year includes ring-fenced income and his or her adjusted income for the tax year is less than €400,000, the amount determined by the formula -

where -

A is the individual's adjusted income for the year, and

B is an amount determined by the formula -

T + S

where T and S have the same meanings respectively as they have in the definition of 'adjusted income';

' relief threshold amount ', in relation to a tax year and an individual, means €80,000;",

(b) in section 485C(1) by deleting the definition of "threshold amount",

(c) in section 485D -

(i) in paragraph (a) by substituting "the income threshold amount" for "the threshold amount",