Table of Contents

Document Overview

OPE20 Basic indicator approach (paras. 20.1-20.5) (effective as of 15 December 2019) (updated 27 March 2020)

This chapter describes the Basic Indicator Approach for calculating operational risk capital requirements. This is the simplest of the three approaches.

Version effective as of 15 Dec 2019

Updated the out of force date to 31 Dec 2022, given the revised implementation date of Basel III announced on 27 March 2020.

20.1 Banks using the Basic Indicator Approach must hold capital for operational risk equal to the average over the previous three years of a fixed percentage (denoted alpha) of positive annual gross income. Figures for any year in which annual gross income is negative or zero should be excluded from both the numerator and denominator when calculating the average. [If negative gross income distorts a bank's Pillar 1 capital charge, supervisors will consider appropriate supervisory action under Pillar 2.]

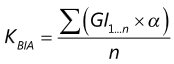

20.2 The capital requirement under the Basic Indicator Approach, KBIA, may be expressed as follows, where GI is annual gross income, where positive, over the previous three years; n is the number of the previous three years for which gross income is positive; and α is 15% (set by the Committee, relating the industry-wide level of required capital to the industry-wide level of the indicator).

20.3 Gross income is defined as net interest income plus net non-interest income. [As defined by national supervisors and/or national accounting standards.] It is intended that this measure should:

(1) be gross of any provisions (eg for unpaid interest);