Table of Contents

Document Overview

CRE52 Standardised approach to counterparty credit risk (paras. 52.1-52.77) (effective as of 1 January 2023)

This chapter sets out the standardised approach for counterparty credit risk (SA-CCR).

Version effective as of 01 Jan 2023

Updated to include the following FAQ: CRE52.51 FAQ2.

Overview and scope

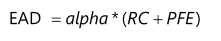

52.1 The Standardised Approach for Counterparty Credit Risk (SA-CCR) applies to over-the-counter (OTC) derivatives, exchange-traded derivatives and long settlement transactions. Banks that do not have approval to apply the internal model method (IMM) for the relevant transactions must use SA-CCR, as set out in this chapter. EAD is to be calculated separately for each netting set (as set out in CRE50.15, each transaction that is not subject to a legally enforceable bilateral fnetting arrangement that is recognised for regulatory capital purposes should be interpreted as its own netting set). It is determined using the following formula, where:

(1) alpha = 1.4

(2) RC = the replacement cost calculated according to CRE52.3 to CRE52.19

(3) PFE = the amount for potential future exposure calculated according to CRE52.20 to CRE52.76

FAQ1

How should the EAD be determined for sold options where premiums have been paid up front?