4.1 Reporting of IRS (paras. 407-410)

407. When reporting IRS, the counterparties should describe the underlying fixed or floating rates in the dedicated rate fields for leg 1 and leg 2 (fields 2.79-2.110) , rather than e.g. providing the floating rate in the underlying index field.

408. There are three distinct fields to describe a floating rate:

a. Identifier (fields 2.83 and 2.99) , which should be populated with ISIN,

b. Indicator (fields 2.84 and 2.100) which should be populated with a standardised 4-letter code, and

c. Name (fields 2.85 and 2.101) , which should be populated with the full name of the rate.

409. Counterparties should always report ISIN and 4-letter code, to the extent that they are available for a given rate. The name of the rate should be reported in all cases.

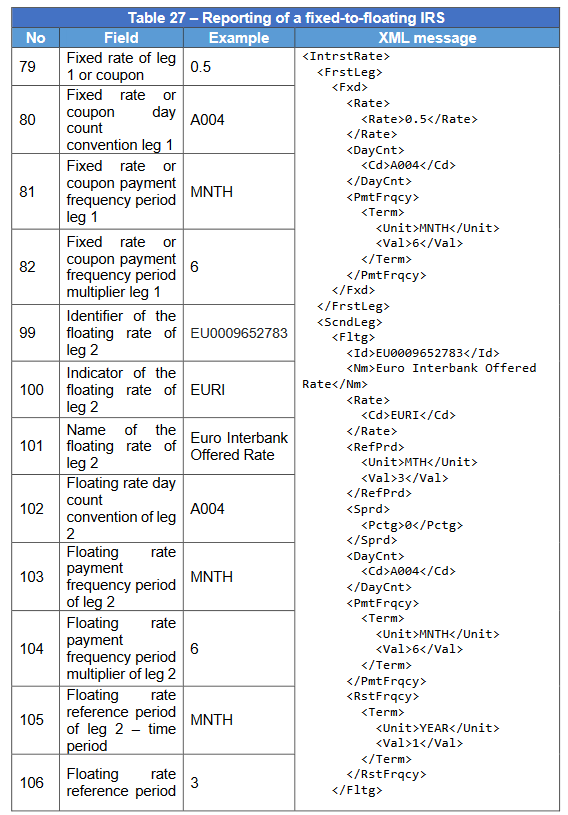

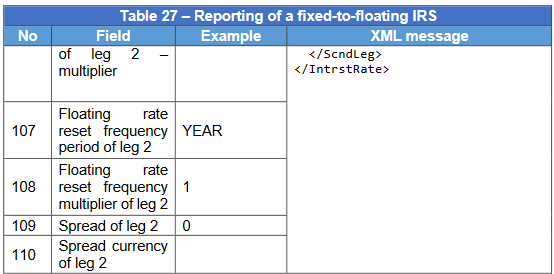

Fixed-to-floating IRS

410. A single currency fixed-to-floating 5-year IRS on 3M EURIBOR vs 0.5% (with no additional spread) . Counterparties exchange payments each six months and reset frequency is set to annual. The day count convention is Actual/360.