4.4.1 FX swaps (spot-forward and forward-forward) (paras. 424-425)

424. Following scenarios are considered:

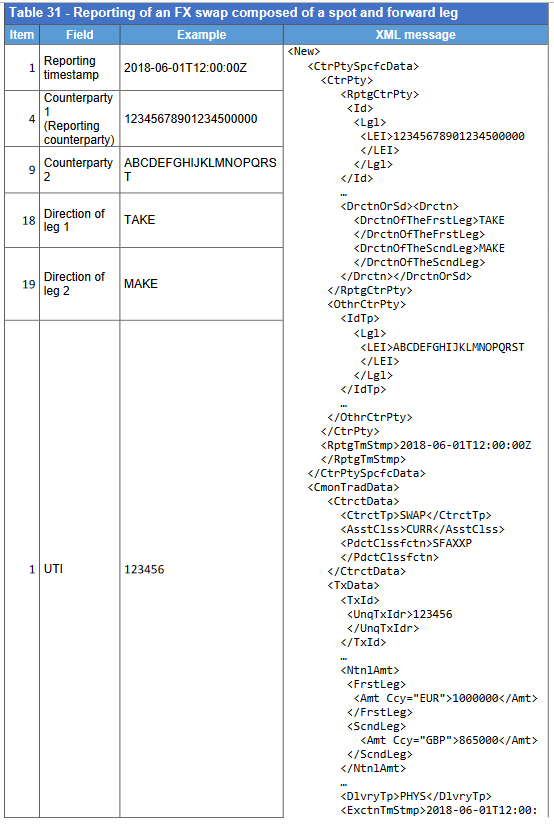

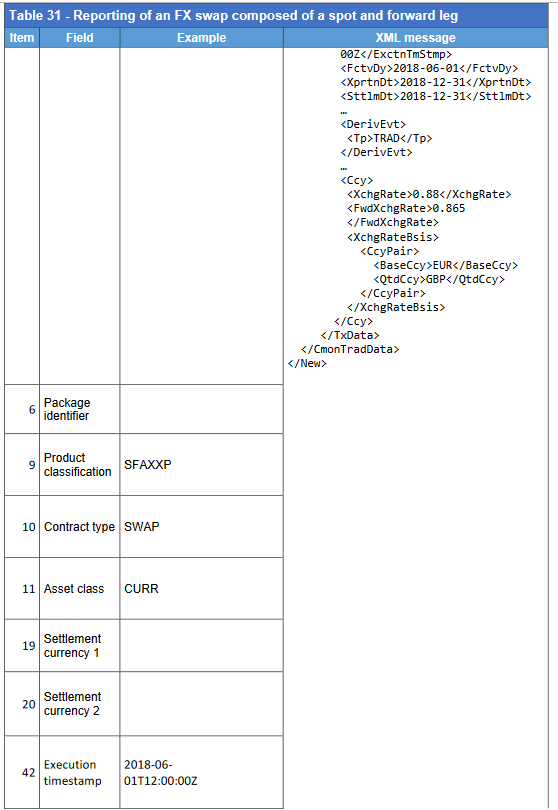

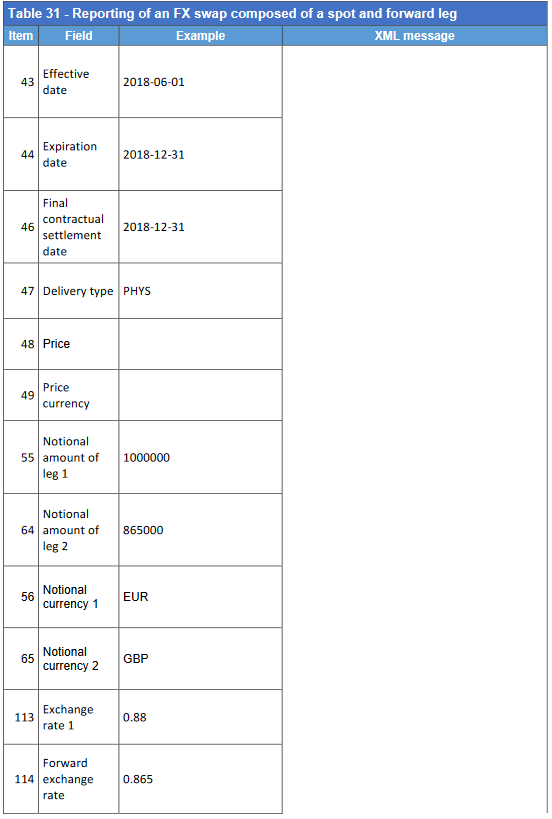

f. -Scenario A: Reporting of an FX swap composed of a spot and forward leg.

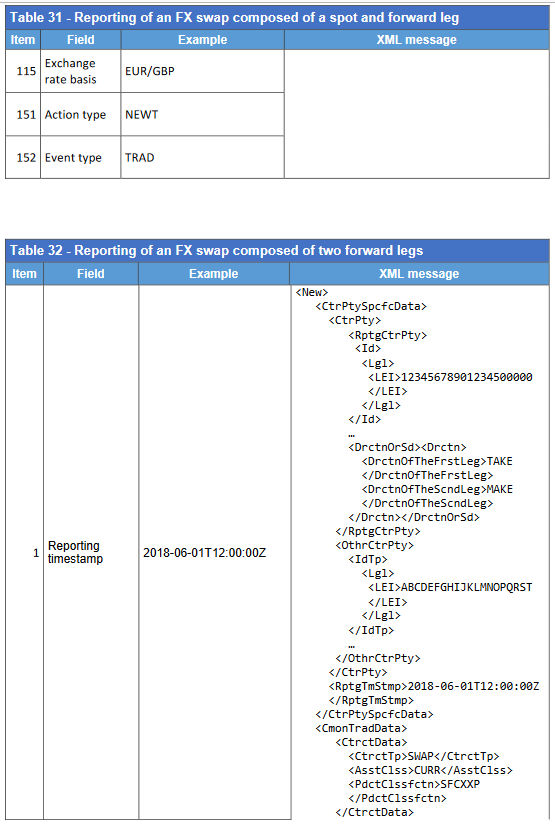

g. Scenario B: Reporting of an FX swap composed of two forward legs.

425. In both scenarios the derivatives have the following characteristics:

- Banks A and B enter in a EUR/GBP swap instrument on 1 June 2018 (regardless of how the instrument has been subsequently confirmed or settled) ;

- notional of the contract: 1,000,000 EUR;

- maturity date of the contract: 31 December 2018;

- the swap is physically settled;

- Bank A delivers GBP and receives EUR for the far leg; thus it is identified as the receiver of leg 1 ( i.e. it receives the currency reported in the field 'Notional currency 1', EUR) ;

- the exchange rate of the near leg is 0.88 EUR/GBP, while the exchange rate of the far leg is 0.865 EUR/GBP.