Version date: 23 October 2023 - onwards

4.4.3 FX option (paras. 430-431)

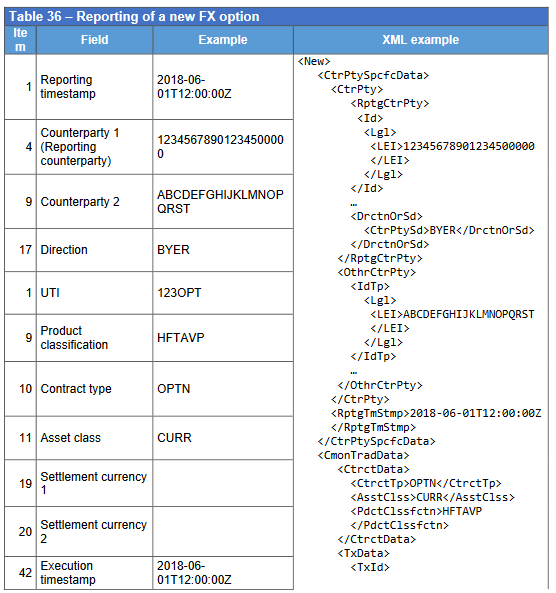

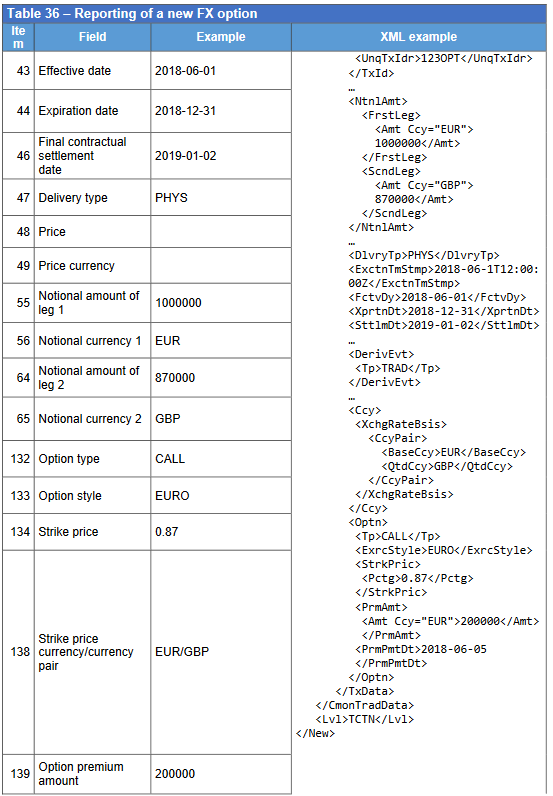

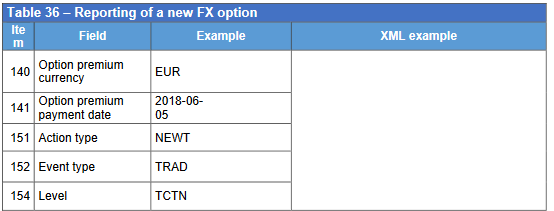

430. Considering a currency option with the following setup:

- Banks A and B enter in a EUR/GBP European call option instrument on 1 June 2018

- notional of the contract: 1,000,000 EUR;

- maturity date of the contract: 31 December 2018;

- the option is physically settled;

- Bank A is the buyer of the option;

- the strike of the option is 0.87;

- option premium is 200,000 EUR and is paid on 5 June 2018.

431. The option has only one leg and the direction should be defined in accordance with the buyer/seller model. It should be determined by which counterparty buys or sells the option.