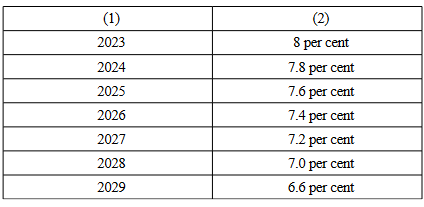

(1) For the purpose of applying section 111AE(3), the value of 5 per cent shall be replaced, for each fiscal year beginning in the calendar year set out in column (1) of the Table to this subsection, with the values set out in the column (2) of that Table:

(2) For the purpose of applying section 111AE(4), the value of 5 per cent, shall be replaced, for each fiscal year beginning in the calendar year set out in column (1) of the Table to this subsection, with the values set out in column (2) of that Table: