5.19 Block 12: Change in notional

5.19.1 Increase in notional

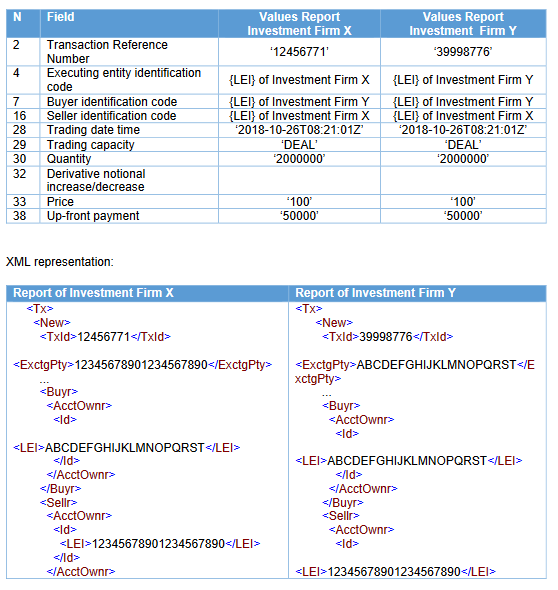

Investment Firm X sells protection to Investment Firm Y on 26 October 2018 at 08:21:01 for EUR 2 million in a credit default swap. The credit default swap has a fixed coupon of 100bps and an up-front payment of EUR 50000 received by Investment Firm X. Investment Firm X and Firm Y are acting on own account.

How should Investment Firms X and Y report?

Note the up-front payment (Field 38) should show a positive value in the transaction report of both Investment Firm X and Firm Y, the Firm buying the protection, since the seller of the credit default swap is receiving the amount.

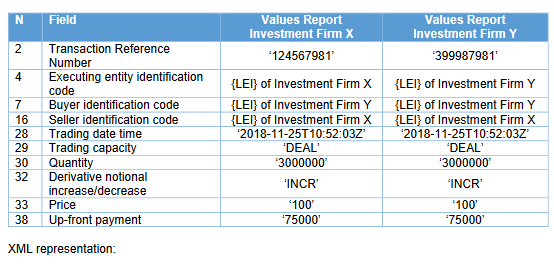

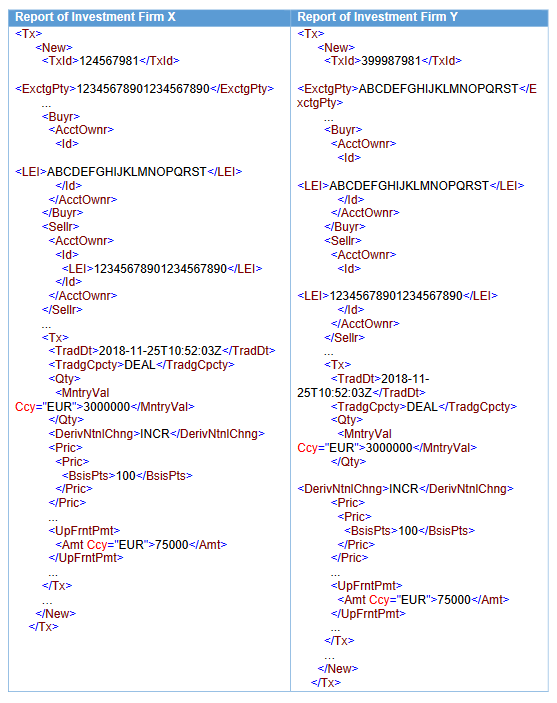

On 25 November 2018 at 10:52:03 the parties to the above CDS contract agree to increase the notional to EUR 5 million and set an additional payment received by Investment Firm X of EUR 75000. The coupon payments remain unchanged.

How should Investment Firms X and Y report the increase in notional?