5.29 Hedging through contracts for difference (CFDs)

Example 83

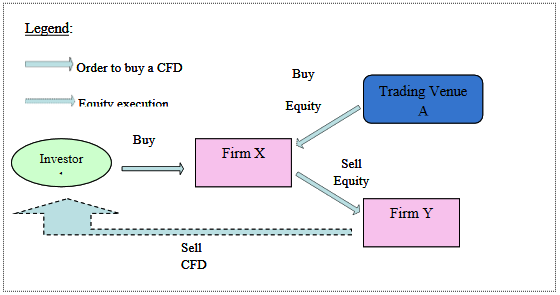

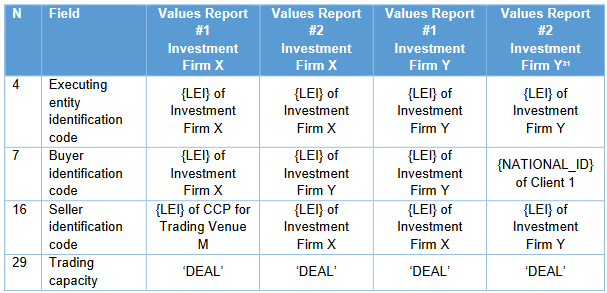

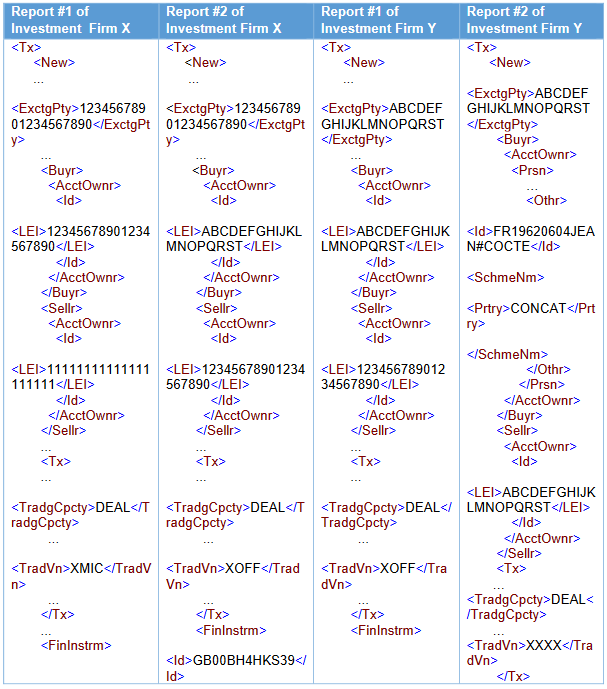

Client 1 gives an order to Investment Firm X for contracts for difference (CFDs) on a specific underlying share (e.g. Vodafone). The ISIN code of the underlying equity is GB00BH4HKS39. Investment Firm X buys the share on Trading Venue M (to acquire the hedge) and passes this transaction (sells the share) to Investment Firm Y (its prime broker) who will then enter into the CFD contract directly with Client 1. Investment Firms X and Y are both acting on own account.

In this scenario, both Investment Firm X and Firm Y should have transaction reporting obligations as they both have executed transactions: Investment Firm X buying and selling the share and Investment Firm Y both buying the share and selling the CFD to Client 1.

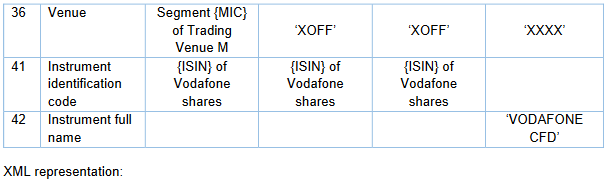

How should Investment Firms X and Y report?

Investment Firm Y’s Report #2 would include other instrument reference data information not displayed above. For reporting OTC CFDs, please refer to Part IV of the guidelines.