5.24 OTF acting on a matched principal basis

An OTF when acting on a matched principal basis is acting in a similar way as an Investment Firm and reports in a similar way as an Investment Firm. All parties dealing with the OTF and the OTF will report the Venue Field as the segment MIC of the OTF. An OTF acting on a matched principal basis matches a buy side order from one or more clients with a sell side orders from one or more clients.

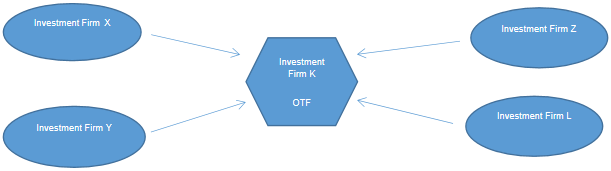

Example 61

Investment Firm K, an OTF, with a LEI of OTFOTFOTFOTFOTFOTFOT and a segment MIC of OTFX, is acting on a matched principal basis and its algo with a code of ‘1234ABC’, matches a buy order for sovereign debt instruments from two Investment Firms, Firm X and Firm Y, with two sell orders from two other Investment Firms, Firm Z and Firm L. Investment Firm L has a LEI of 77777777777777777777.

Investment Firms X and Y are buying 300 and 100 sovereign debt instruments respectively and Investment Firms Z and L are selling 150 and 250 sovereign debt instruments respectively.

Investment Firms X, Y, Z and L are all acting in an own account trading capacity. Trader 1 made the investment decision and carried out the execution for Investment Firm X. Trader 4 made the investment decision and carried out the execution for Investment Firm Y. Trader 5 made the investment decision and carried out the execution for Investment Firm Z. Trader 9 made the investment decision and carried out the execution for Investment Firm L. Trader 9 is Patrick Down an Irish national with date of birth of 14 July 1960.

Investment Firm K matches the orders on 9 June 2018 at 16:41:07.1234Z and at a price of EUR 42.7.

Investment Firm Z is short selling without an exemption, Investment Firm L is not short selling.

How should Investment Firm K (OTF) report?