5.27 Investment Firm acting under a discretionary mandate for multiple clients

5.27.1 Investment Firm acting under a discretionary mandate for multiple clients without meeting transmission conditions (combination of aggregated orders and chains/transmission)

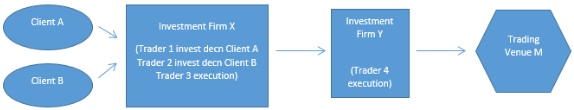

Example 76

Investment Firm X is acting for Client A and Client B under discretionary mandates. Trader 1 decides to buy 400 units of a given financial instrument for Client A. Trader 2 decides to buy 200 of the same financial instrument for Client B. Trader 3 sends the aggregated order to Investment Firm Y to fill. The order is then filled on Trading Venue M, by Trader 4 in two executions, one on 24 June 2018 at 14:25:30.1264 for 350 instruments at EUR 30 and one on 24 June 2018 at 15:55:40.3452 for 250 instruments at EUR 32.5. The Trading Venue provides transaction identification codes of ‘1234’ and ‘6789’ for the transactions respectively.

If instead Investment Firm X was a fund management company managing a fund and was not an Investment Firm, the fund management company should be identified by Investment Firm Y as the buyer/seller and the decision maker fields should not be populated, since the fund management company is not an Investment Firm, has not transaction reporting obligations and it cannot transmit.

How Investment Firm X reports depends on how Investment Firm Y confirms the executions to Investment Firm X as illustrated below.

Similarly, how Client A and Client B would report if they were Investment Firms depends on how Investment Firm X confirms the executions to them.

Investment Firm X is not meeting the transmission conditions under Article 4 of Commission Delegated Regulation (EU) 2017/590.