6.11 Liquidity provision activity (Field 8)

The liquidity provision activity by members or participants of Trading Venues generally occurs in one of the following three scenarios:

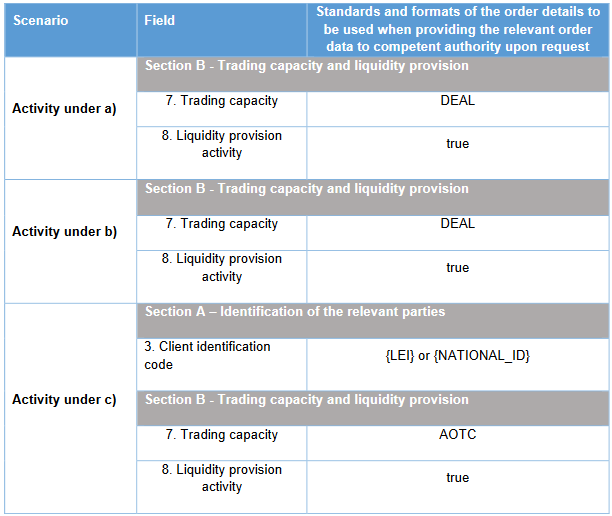

a) a member or participant engages in algorithmic trading to pursue a market making strategy and, as a consequence, enters into an agreement with a Trading Venue under Article 17 and Article 48 MiFID II;

b) a member or participant performing a liquidity provision activity (not being captured as a market making strategy under Article 17 of MiFID II) deals on own account under an agreement with the issuer or the Trading Venue;

c) a member or participant performing a liquidity provision activity executes orders on behalf of clients under an agreement with the issuer or the Trading Venue.

The liquidity provision activities listed under a) to c) need to be reflected in the Trading Venue’s record through the appropriate population of Field 7 (Trading capacity), Field 8 (Liquidity provision) and Field 3 (Client identification code) if executing orders on behalf of clients.

Example 125