5.25 Value based transactions with a balancing unit

This may take place where Investment Firms offer daily aggregated dealing as a cost effective option for retail clients.

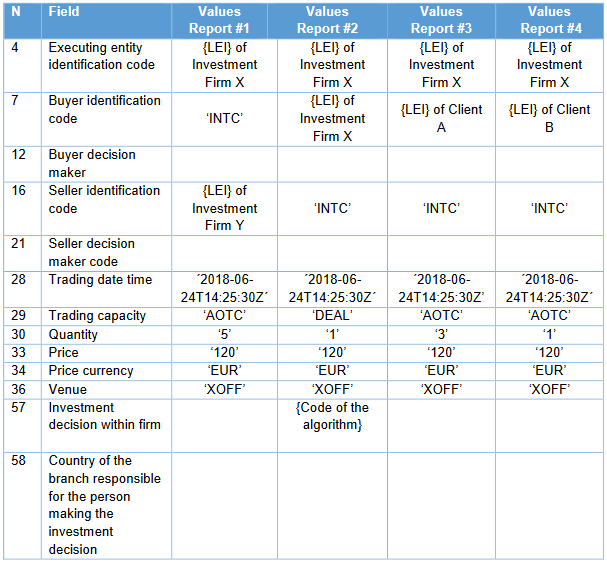

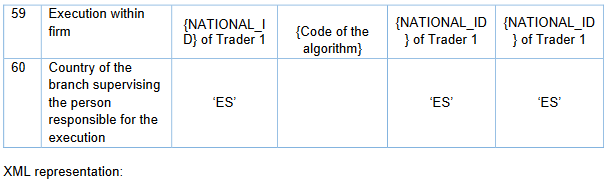

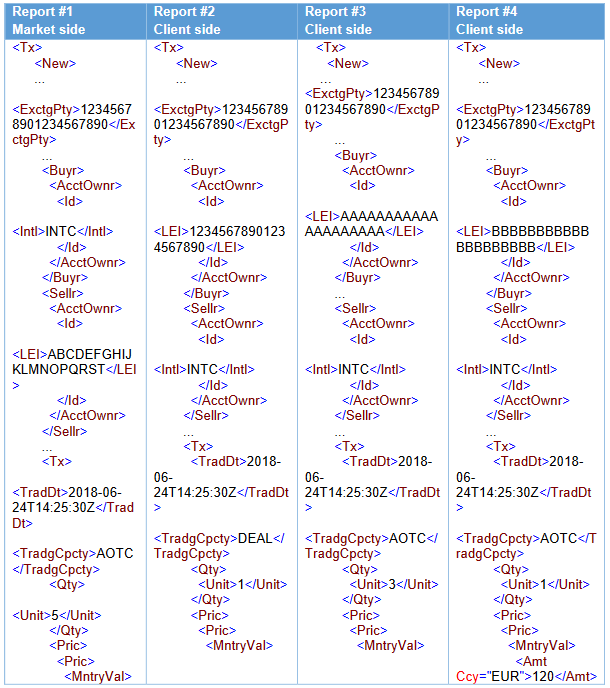

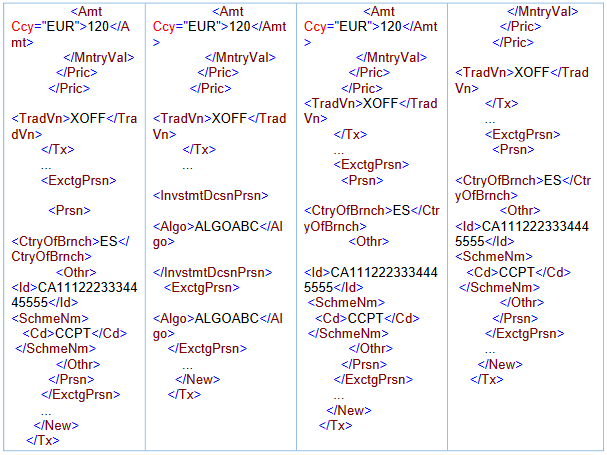

Example 62

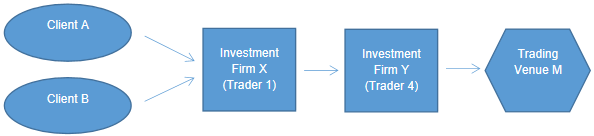

Two clients of a Spanish Investment Firm X decide to buy the same financial instrument, Client A for a value of EUR 400 and Client B for a value of EUR 200. Trader 1 sends the aggregated order for value of EUR 600 to Investment Firm Y. Trader 4 executes the order in one execution on Trading Venue M on 24 June 2018 at 14:25:30.1264 for five units of the instrument at a price of EUR 120 and confirms the completed execution to Investment Firm X. Investment Firm X allocates three of those units to Client A with a value of EUR 360, and one unit to Client B with a value of EUR 120. The balancing unit of one instrument is allocated by the systems of Investment Firm X (‘ALGOABC’) to its own account with the intention to sell it when possible. This holding is for administrative purposes rather than being intended as a proprietary investment.

Investment Firm X is not meeting the conditions for transmission of an order under Article 4 of Commission Delegated Regulation (EU) 2017/590.

How should Investment Firm X report?