5.22 One order for one client executed in multiple transactions

5.22.1 Filling the client’s order by executing on a venue and then providing to the client from the Investment Firm’s own book

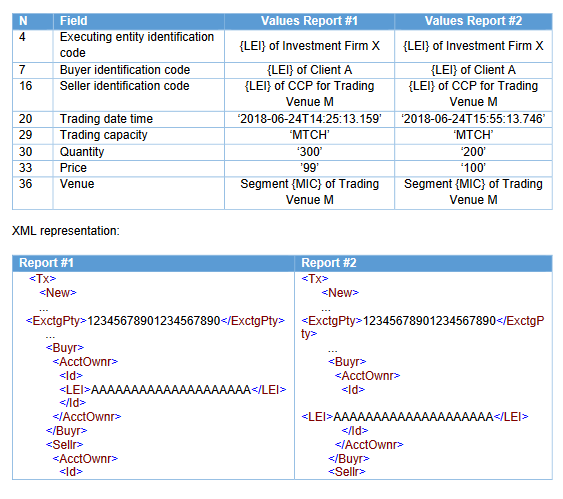

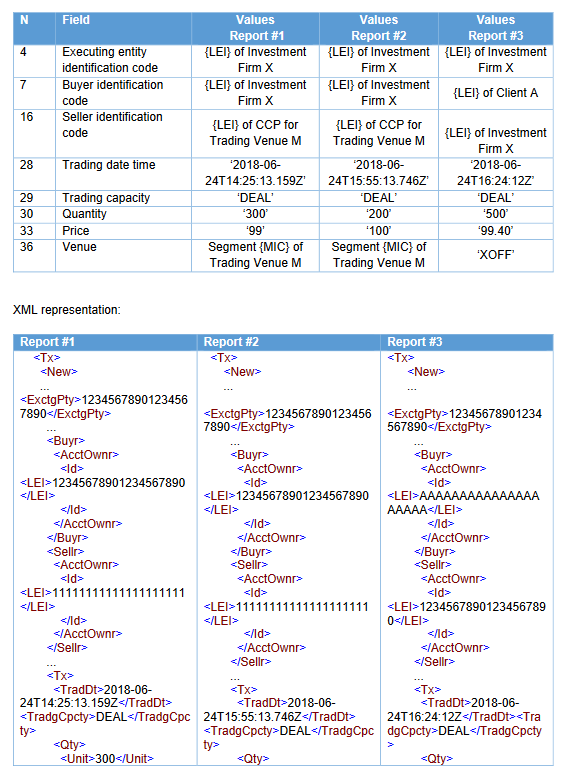

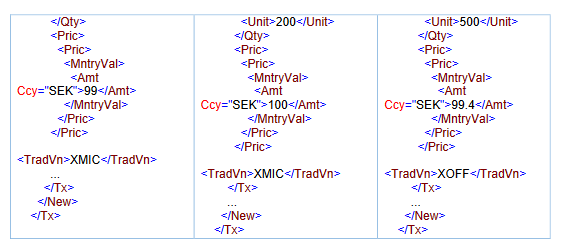

Client A places an order to purchase 500 shares with Investment Firm X.

Investment Firm X fills the order on Trading Venue M in two executions, one on 24 June 2018 at 14:25:13.159124 for 300 shares at SEK 99 and one on 24 June 2018 at 15:55:13.746133 for 200 shares at SEK 100. The client wants to receive an average price.

a) Investment Firm X deals on own account

The transactions are first booked in Investment Firm X’s own books and then booked later to the client at 16:24:12 on the same day at a volume weighted average price of SEK 99.40.

How should Investment Firm X report?

b) Investment Firm deals on a matched principal basis

How should Investment Firm X report?