5.2 Trading capacity

As set out in the Commission Delegated Regulation (EU) 2017/590 (Field 29), there are three different trading capacities that may be reported: dealing on own account, matched principal and ‘any other capacity’. The reported trading capacity should reflect the capacity in which the Investment Firm actually traded and should be consistent with the rest of the information in the Investment Firm’s transaction report(s).

5.2.1 Dealing on own account (DEAL)

Where an Investment Firm is dealing on own account it should be reported as either the buyer or seller in the transaction report. The corresponding seller or buyer will be the counterparty or client or Trading Venue [As set out in Block 7.] that the Investment Firm is dealing with. The Investment Firm may be acting purely to action its own proprietary trades or may be acting on own account with a view to filling orders that it has received from a client. In the latter case, the trading time and date for the client side report may be the same as for the market side report or could be later and the price of the market side and client side report could be the same or could differ.

5.2.1.1 Dealing for itself

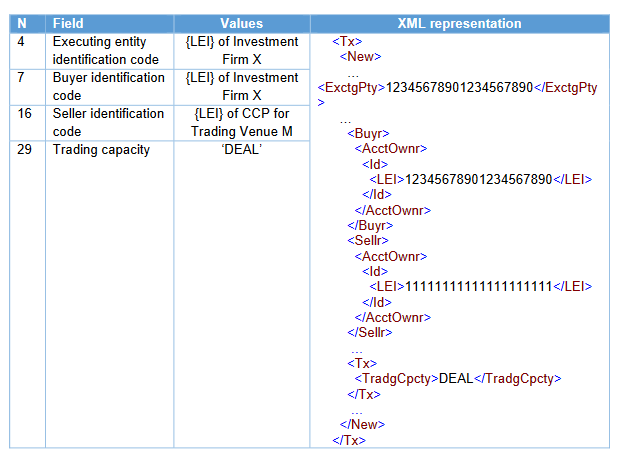

Example 1

Investment Firm X dealing on own account on a proprietary basis purchases financial instruments on Trading Venue M.

Investment Firm X’s report should be:

5.2.1.2 Dealing for a client

Example 2