5.27.1 Investment Firm acting under a discretionary mandate for multiple clients without meeting transmission conditions (combination of aggregated orders and chains/transmission)

Example 76

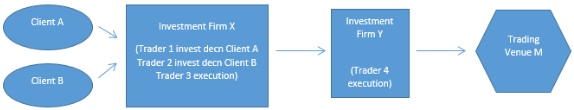

Investment Firm X is acting for Client A and Client B under discretionary mandates. Trader 1 decides to buy 400 units of a given financial instrument for Client A. Trader 2 decides to buy 200 of the same financial instrument for Client B. Trader 3 sends the aggregated order to Investment Firm Y to fill. The order is then filled on Trading Venue M, by Trader 4 in two executions, one on 24 June 2018 at 14:25:30.1264 for 350 instruments at EUR 30 and one on 24 June 2018 at 15:55:40.3452 for 250 instruments at EUR 32.5. The Trading Venue provides transaction identification codes of ‘1234’ and ‘6789’ for the transactions respectively.

If instead Investment Firm X was a fund management company managing a fund and was not an Investment Firm, the fund management company should be identified by Inv

…