5.35.1 Equity or equity-like instruments

Example 91

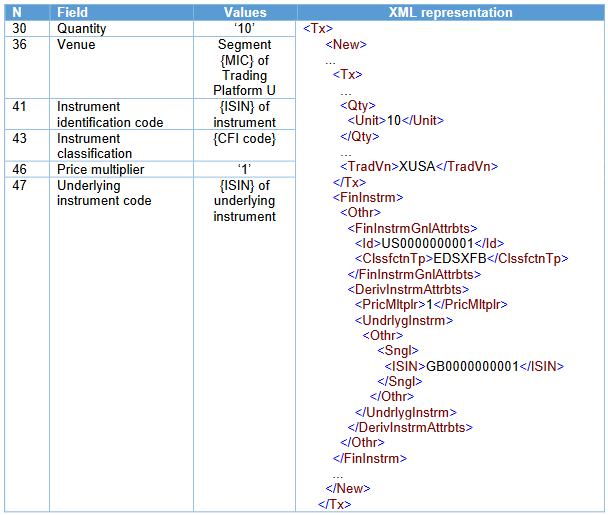

An Investment Firm trades 10 ADRs (ISIN: US0000000001) on the US market (MIC:XUSA). The underlying instrument (ISIN: GB0000000001) is admitted to trading or traded on a Trading Venue. The CFI code is EDSXFB.

5.35.2 Bonds or other form of securitised debt

5.35.2.1 Scenario where transaction was done in the clean price [Clean Price = Dirty price - Accrued Interest]

Example 92

An Investment Firm acquires a bond or securitised debt financial instrument EDF 2.25% 2021 (ISIN Code FR0011637586) by trading over the counter at 98. The nominal amount of the transaction is EUR 1000000.

The net amount for this transaction is EUR 982650.68. Considering that for the purpose of this example:

The static characteristics (as defined upon the issue of the financial instrument) are:

- Maturity Date: April 27th 2021

- Nominal coupon: 2.25%

- Coupon frequency: annual

- Day Count Convention: ACT/ACT (i.e. Actual/Actual) [ACT/ACT is the ICMA recommended c

…