Table of Contents

Related

Document Overview

Article 37 Calculation of the risk margin

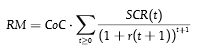

1. The risk margin for the whole portfolio of insurance and reinsurance obligations shall be calculated using the following formula:

where:

(a) CoC denotes the Cost-of-Capital rate;

(b) the sum covers all integers including zero;

(c) SCR(t) denotes the Solvency Capital Requirement referred to in Article 38(2) after t years;

(d) r(t + 1) denotes the basic risk-free interest rate for the maturity of t + 1 years.

The basic risk-free interest rate r(t + 1) shall be chosen in accordance with the currency used for the financial statements of the insurance and reinsurance undertaking.

2. Where insurance and reinsurance undertakings calculate their Solvency Capital Requirement using an approved internal model and determine that the model is appropriate to calculate the Solvency Capital Requirement referred to in Article 38(2) for each point in time over the lifetime of the insurance and reinsurance obligations, the insurance and reinsurance undertakings shall use the internal model to calculate the amounts SCR(t) referred to in paragraph 1.