Table of Contents

Document Overview

Article 134 Credit and suretyship risk sub-module

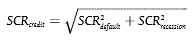

1. The capital requirement for credit and suretyship risk shall be equal to the following:

where:

(a) SCRdefault is the capital requirement for the risk of a large credit default;

(b) SCRrecession is the capital requirement for recession risk.

2. The capital requirement for the risk of a large credit default shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous default of the two largest exposures relating to obligations included in the lines of business 9 and 21 of an insurance or reinsurance undertaking. The calculation of the capital requirement shall be based on the assumption that the loss-given-default, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, of each exposure is 10 % of the sum insured in relation to the exposure.

3. The two largest credit insurance exposures referred to in paragraph 2 shall be determined based on a comparison of the net loss-given-default of the credit insurance exposures, being the loss-given-default after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.