Table of Contents

Page Overview

Document Overview

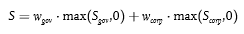

Article 50 Formula to calculate the spread underlying the volatility adjustment

For each currency and each country the spread referred to in Article 77d(2) and (4) of Directive 2009/138/EC shall be equal to the following:

where:

(a) wgov denotes the ratio of the value of government bonds included in the reference portfolio of assets for that currency or country and the value of all the assets included in that reference portfolio;

(b) Sgov denotes the average currency spread on government bonds included in the reference portfolio of assets for that currency or country;

(c) wcorp denotes the ratio of the value of bonds other than government bonds, loans and securitisations included in the reference portfolio of assets for that currency or country and the value of all the assets included in that reference portfolio;

(d) Scorp denotes the average currency spread on bonds other than government bonds, loans and securitisations included in the reference portfolio of assets for that currency or country.