Table of Contents

Page Overview

Document Overview

Article 204

1. The capital requirement for the operational risk module shall be equal to the following:

SCROperational = min(0,3 • BSCR;Op) + 0,25 • Expul

where:

(a) BSCR denotes the Basic Solvency Capital Requirement;

(b) Op denotes the basic capital requirement for operational risk charge;

(c) Expul denotes the amount of expenses incurred during the previous 12 months in respect of life insurance contracts where the investment risk is borne by policy holders.

2. The basic capital requirement for operational risk shall be calculated as follows:

Op = max(Oppremiums;Opprovisions)

where:

(a) Oppremiums denotes the capital requirement for operational risks based on earned premiums;

(b) Opprovisions denotes the capital requirement for operational risks based on technical provisions.

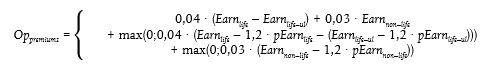

3. The capital requirement for operational risks based on earned premiums shall be calculated as follows:

where:

(a) Earnlife denotes the premiums earned during the last 12 months for life insurance and reinsurance obligations, without deducting premiums for reinsurance contracts;