Table of Contents

Document Overview

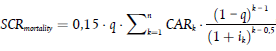

Article 91 Simplified calculation of the capital requirement for life mortality risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life mortality risk as follows:

where, with respect to insurance and reinsurance policies with a positive capital at risk:

(a) CARk denotes the total capital at risk in year k, meaning the sum over all contracts of the higher of zero and the difference, in relation to each contract, between the following amounts:

(i) the sum of:

- the amount that the insurance or reinsurance undertaking would pay in year k in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

- the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay after year k in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

(ii) the best estimate of the corresponding obligations in year k after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

(b) q denotes the expected average mortality rate over all the insured persons and over all future years weighted by the sum insured.