Article 384 Standardised method

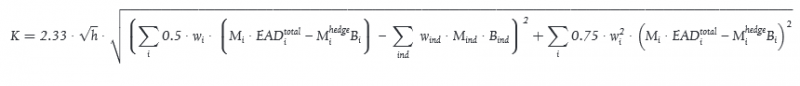

1. An institution which does not calculate the own funds requirements for CVA risk for its counterparties in accordance with Article 383 shall calculate a portfolio own funds requirements for CVA risk for each counterparty in accordance with the following formula, taking into account CVA hedges that are eligible in accordance with Article 386:

where:

h = the one-year risk horizon (in units of a year); h = 1;

wi = the weight applicable to counterparty "i".

Counterparty "i" shall be mapped to one of the six weights wi based on an external credit assessment by a nominated ECAI, as set out in Table 1. For a counterparty for which a credit assessment by a nominated ECAI is not available:

(a) an institution using the approach in Title II, Chapter 3 shall map the internal rating of the counterparty to one of the external credit assessment;

(b) an institution using the approach in Title II, Chapter 2 shall assign wi=1.0 % to this counterparty. However, if an in

…