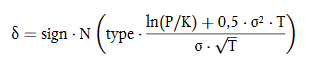

1. Institutions shall calculate the supervisory delta as follows:

(a) for call and put options that entitle the option buyer to purchase or sell an underlying instrument at a positive price on a single or multiple dates in the future, except where those options are mapped to the interest rate risk category, institutions shall use the following formula:

where:

δ = the supervisory delta;

sign = – 1 where the transaction is a sold call option or a bought put option;

sign = + 1 where the transaction is a bought call option or sold put option;

type = – 1 where the transaction is a put option;

type = + 1 where the transaction is a call option;

N(x) = the cumulative distribution function for a standard normal random variable meaning the probability that a normal random variable with mean zero and variance of one is less than or equal to x;

P = the spot or forward price of the underlying instrument of the option; for options the cash flows of which depend on an average value of the price

…